Contents:

For example, if the first screen shows an uptrend, we’ll be trading only with buy positions. Similarly, if the first screen shows a downtrend, we’ll only trade with sell positions. Trend indicators are designed to measure the strength and direction of a trend. Daily Pips Hunter is a manual trading strategy designed for those who prefer to make their own trading decisions instead of relying on automated robots. It’s a non-repaint trading system that uses technical indicators to analyze market conditions and provide valuable insights for traders. A buy signal is then generated, and a 5 vs. 14 cross should happen when the 5 period is oversold .

GBP/USD Forecast: Sterling Looks at Overhead Resistance – DailyForex.com

GBP/USD Forecast: Sterling Looks at Overhead Resistance.

Posted: Fri, 31 Mar 2023 09:02:48 GMT [source]

When the ROC indicator is around the center line 0, the market must be consolidating. If the ROC is above the zero line, the market is bullish, if the indicator is below the zero value, the market is bearish. TheLaguerre indicator is a trend-following indicator, designed as an oscillator, whose values vary in the range of 0-1. In some modifications, there are now values limiting the range.

Trend Following Indicators

In best indicators for day trading forexer timeframes, there are many incomplete patterns interrupting the indicator working procedure. Max and Min are extreme price values for the period Z specified in the settings. Max and Min are extreme price values for the period M specified in the settings. Max and Min are extreme price values for the period N specified in the settings. Pattern indicators are designed to spot the chart patterns that have already formed or just started forming and are not visible in the chart yet. The EMA indicator also reverses following the price, but a little later, at points “2”, “4”, “6”, “8”.

- https://g-markets.net/wp-content/themes/barcelona/assets/images/placeholders/barcelona-sm-pthumb.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-NCdZqBHOcM9pQD2s.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/male-hand-with-golden-bitcoin-coins-min-min.jpg

This article will highlight what makes this indicator special, including what it does, how to calculate it and what traders use it for. If you are a swing trader looking to identify the start and finish of a swing or trend, then trend and momentum indicators could prove to be invaluable. In contrast, a scalper operating off a one-minute timeframe will have little use for either. They illustrate the velocity and magnitude of a security’s price movements.

But the works you put in needs to be wise and smart, and it requires you to understand the trading world to gain maximum profits. After all, your goal is to achieve maximum gains from slight movements of prices. When the indicator is moving in a different direction than the price, it shows that the current price trend is weakening and could soon reverse. When the Aroon Up crosses above the Aroon Down, that is the first sign of a possible trend change. If the Aroon Up hits 100 and stays relatively close to that level while the Aroon Down stays near zero, that is positive confirmation of an uptrend.

Looking for a fast and convenient way to sell your house? Connect with buyers through https://www.companiesthatbuyhouses.co/pennsylvania/home-buying-company-hanover-pa/ and get cash offers.

What are Lagging Indicators?

It helps to determine the moments of trend strengthening, potential points of the trend end. The FI confirms the trend strength, spots corrections; therefore, it could be used in swing trading. The sharp movement up or down relative to previous periods, confirming the trend, is taken into account. If the level of the current closing price is higher than the average value for the previous period, the market is in the accumulation stage. If the current close is lower than the average value, there is distribution in the market.

Forex technical traders use the POC levels to identify the best stop loss points and take profit points. Moreover, the indicator plots lines and bars for easy visual identification of these areas where the price is expected to retest. A moving average is a technical analysis indicator that helps level price action by filtering out the noise from random price fluctuations.

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-KGbpfjN6MCw5vdqR.jpeg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth-164×164.jpg

If the indicator line does not follow the market price lower it is considered a bearish momentum failure where a reversal higher could be more likely. The Williams %R indicator can be used as an overbought and oversold indicator as well as a divergence indicator as well. When the Bollinger Bands are flat, close together, and contracting it indicates the volatility of the market is low and potentially more range based.

What is the most accurate forex indicator?

It calculates the extent to which price changes in a day. After that, Andrew Cardwell included positive and negative reversals into the indicator. And then, Constance Brown improved the overall indicator finally. Just like any other tool, day trading has many indicators in the market.

The second correction ends at point 4 (0.382), this level is one of the key ones. Here, if the trend turned up, one could have added up to the trade. The price goes up, the take-profits for 50% of both trades are set at the 0% level. The remaining 50% are protected with a trailing stop corresponding to the distance between points 0.236 and 0%.

Step 4: Choose your market and forex indicator!

The signals are easy to interpret, a blue arrow marks the beginning of a bullish price reversal. On the other hand, the red arrow marks a potential bearish trend reversal point. Additionally, this MetaTrader indicator plots wavy horizontal lines beside the Buy and Sell arrow trading signals. A forex chart graphically depicts the historical behavior, across varying time frames, of the relative price movement between two currency pairs. The trade shown below assumes that a short trade was entered in the forex market for the euro/yen on January 1, 2010. The chart below displays the euro/yen cross with 20-day Bollinger Bands overlaying the daily price data.

For example, a downward correction occurs in the uptrend, and oscillators are in the overbought zone. In this case, one should not put an order at the correction end as the price can continue moving down. The advantage of intraday trading is that almost all indicators can be used in such a type of trading strategy, provided the settings are optimized. In classical interpretation, the indicator determines the potential trend reversal points. The Pivot Point indicator is used to visually identify the key levels and the levels to set stop loss and take profit.

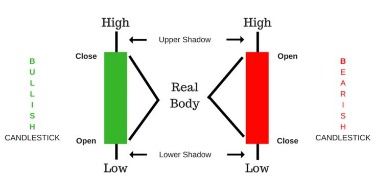

The Alligator employs the median price, calculated as the arithmetic mean of the high and the low. N is the period, the number of candlesticks analyzed, you specify in the settings. Close is the closing price of each candlestick in the sequence. In MA settings, you can also specify other types of prices. These tools help to evaluate the potential strength of the trend. Lagging indicators provide the information calculated based on the data for the previous and the current periods.

Other technical indicators can help give useful insight into market movements and price trends as well. You can consider the trend to be strong when the ADX is more than 25. ADX is a popular technical indicator that helps traders to understand trend strength – many different markets use this indicator. Day traders can use this indicator to find out about extreme market conditions. As a result, day traders can figure out where prices can reverse and bring them losses. Day trading is a very skillful task for traders, and if you are not good at it, you will incur losses.

FXCM is a https://g-markets.net/ provider of online foreign exchange trading, CFD trading and related services. Both dangers can be somewhat limited when using candlesticks and divergence. The distance between the histogram bars and the zero lines also indicates the strength or lack of momentum. The bands never truly depict changes in the trading environment; the process revolves largely around the guesswork. Bollinger bands are designed to measure the pricing volatility of securities.