Contents:

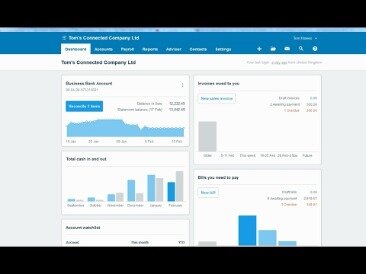

This enables non-https://bookkeeping-reviews.com/ organizations to ensure that they can pay their employees on time, submit year-end forms, and file taxes to avoid critical errors and costly penalties. For instance, the solution enables businesses to automate approvals for more productive workflows. Managers can set approval rights to users based on custom rules to ensure that workflows are properly followed and company budgets and expenses are properly distributed. Unfortunately, NetSuite’s site is pretty sparse, and it’s definitely on the pricier side of accounting software (third parties estimate it starts at around $499 a month).

Similar to Sage Intacct, NetSuite offers specialized, advanced accounting functions for businesses in many industries. At its heart, the product is an ERP program that helps businesses manage both financial and operational tasks from one place. This makes it an especially good option for nonprofits that plan to grow in the future and prefer an all-in-one solution to having to integrate with various third-party apps. NetSuite’s accounting software offers accounts receivable and payable, cash management, fixed asset management, a general ledger and tax management solutions.

You can link your Xero account to Infoodle for seamless donor communication and analysis. Xero’s highly customizable and in-depth reporting tools make Xero stand out. By tracking categories, you know if funds are being allocated to the right projects based on donor intent. Here are the best accounting software for nonprofits available today.

How Keela Integrates with Xero

This is just one software platform for churches offered by Shelby and other products can be bundled for full church management software solutions. Sage Intacct is a leading nonprofit accounting software solution that offers an open API structure, making it easy to integrate your accounting software with Salesforce or your payroll software. Denali FUND is available as both cloud-based options and on-site. You’ll notice that this platform highly emphasizes security with internal controls that allow for GAAP and FASB compliance and help deter fraud while managing fund accounts.

If you require something beyond these offerings, you can purchase a custom add-on as well. You’re not sure of which types of accounting records could suitable for your business or which accountant to hire? No worries, this article will gently accompany you in your knowledge journey. Are you looking for a pro forma income statement template Excel for your business?

If you’re in the market for a new donor database, check out our list of the top donor management solutions to find the perfect provider for you. Since most of your nonprofit’s staff will be familiar with Microsoft’s products, using OneNFP Financials is a natural and easy next step for your accounting software needs. That might seem obvious, but some accounting software was written only with conventional businesses in mind. Try to find a package that was designed with at least some input and feedback from nonprofit entities. You’ll probably have no products or services to sell, at least at the beginning.

The 13 Best Nonprofit Accounting Software Apps

For a side-by-side comparison of these vendors and more, make sure to download our free Top 10 Nonprofit Accounting Software report. We give you the low-down on the industry’s top solutions by comparing pricing, features and deployment methods of the top nonprofit accounting software. Nonprofit organizations are known to manage huge amounts of expenses.

float cash flow forecasting reviews and pricing Invoice helps address this by allowing for invoice tracking so that users are constantly updated regarding expenditures. Mission time can likewise be tracked using the app’s time tracker and projects added to the system with time spent on them tracked individually. Using Bill.com, you can accept donations, record them, and even track newly received contributions. It can be configured to schedule one-time or recurring donations on a monthly, quarterly, or annual basis.

FASB Sets Out Plan to Improve Income Tax Disclosures

For many NPOs, tight budgets and a “make do with what you have” mentality keeps organizations using outdated software solutions and equipment that are well past their prime. Some NPOs continue to rely on applications that are nearly 30 years old. Cut costs with detailed expense tracking – Manage accounts payable, categorize expenses, and find out where most of your church’s money is going. Over time, Wave will reveal valuable money-saving opportunities. Campaign Monitor is a complete email marketing platform that has a range of features specifically designed for non-profits. These include tools for automating tasks, editable templates, and software integrations with other nonprofit applications.

- If your company oversees any programs or projects, you are probably well aware of how challenging it can be to keep track of all the different moving parts involved.

- Here is a closer look at how we evaluated the inclusions for this best-of 2023 list.

- If you’re in the market for an updated solution, the five options above will be the best place to start your search.

- The software solutions in this guide are listed alphabetically, and we took care to include software designed for a variety of nonprofit organizations, including charities, schools, and churches.

- All nonprofits generally face problems when it comes to recording expenses.

Sending out Statements is a great way to keep in touch with the people donating to your organisation. Open and consistent communication builds trust, keeps the donors thinking about you and your cause, and results in more donations being made. Xero has limited control over what people can see and so limits the ability to share this resource with more people.

Accounts by Software 4 Nonprofits is the best nonprofit software for small businesses with basic needs. You can contact the support team via phone, chat, or email if you hit a rough patch. Zoho Books is super useful if you have volunteers and other staff working from different locations. You can provide role-based access and let users work from any location online.

Serenic Navigator is an excellent nonprofit accounting solution for NPOs already using Microsoft products such as Outlook, OneNote or Excel, as it integrates seamlessly with all existing Microsoft applications. The accounting software is built on Microsoft Dynamics NAV 2013, so it’s fully scalable, rapidly deployed and easy to implement. Blackbaud’s comprehensive coverage ensures that your NPO’s donor management, accounting and business processes will all be improved. The company understands the unique parameters that affect nonprofit workflows, so they offer unparalleled financial reporting and restricted fund management tools. The software enables nonprofits with tools and technologies such as Optical Character Recognition. With it, DocuPhase can read the contents of scanned documents and use the information it gathered to fill forms.

Due to its ease of use and comprehensive features, it’s popular with non-profits. If your company oversees any programs or projects, you are probably well aware of how challenging it can be to keep track of all the different moving parts involved. Using software to manage projects will assist you in maintaining control and keeping things organized.

What Are The Benefits of Nonprofit Accounting Software?

At Business.org, our research is meant to offer general product and service recommendations. We don’t guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services. But if you want to accept donations you can’t just sign up for Zoho Books. Zoho Checkout is free as long as you accept only 50 donations—ever, not per month. Clients that need unlimited donations in multiple currencies will need to add a $9 a month Zoho Checkout plan to their existing Zoho Books plan. Business.org showcases its top picks of the best nonprofit budget software providers.

Best Accounting Software For Nonprofits 2023 – Forbes Advisor – Forbes

Best Accounting Software For Nonprofits 2023 – Forbes Advisor.

Posted: Wed, 08 Mar 2023 08:00:00 GMT [source]

File 990 helps nonprofit financial departments save time and money by facilitating the filing of tax forms. Sync Xero seamlessly with third party apps for fundraising and donor management, marketing, payments and workflow management. Information provided on Forbes Advisor is for educational purposes only. Your financial situation is unique and the products and services we review may not be right for your circumstances. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Performance information may have changed since the time of publication.

- You can get even more from the software by using one of its add-ons for your nonprofit.

- Note that you can edit the names at any time and can add new tracking codes as new grants are received or new programs started.

- Performance information may have changed since the time of publication.

- On the other hand, NonProfitPlus doesn’t list any pricing on its site—as with Sage Intacct, you have to get in touch with a representative for a quote.

Bank reconciliation, expense tracking, and invoicing are included. Despite the fact that there are many other software tools that can make your life simpler, these are our top six choices for the software tools that every nonprofit organization ought to have in their toolkit. Before choosing your fund accounting software, it’s important to know exactly what you need and how to get the most out of it. Consider making a list of the following factors and compare your list with the overviews of your option.